Appearance

先锋领航(Vanguard)

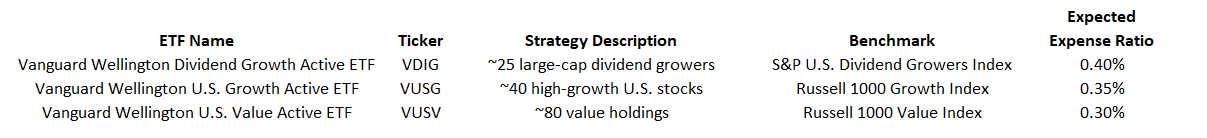

先锋领航计划和Wellington合作推出三只主动股票ETF

Vanguard’s First Stock-Picking ETFs Come With Its Highest Fees Yet

VDIG

The Vanguard Wellington Dividend Growth Active ETF (VDIG) will hold about 25 large-cap dividend payers with strong balance sheets and low turnover. It will be benchmarked to the S&P U.S. Dividend Growers Index, the same index tracked by the $95 billion Vanguard Dividend Appreciation ETF (VIG).

VDIG will be managed by Peter Fisher, a Wellington partner who already manages several of Vanguard’s dividend growth mutual funds, including the Vanguard Dividend Growth Fund (VDIGX).

Morning Star: VDIGX

VUSG

The Vanguard Wellington U.S. Growth Active ETF (VUSG) will own roughly 40 companies with high growth characteristics and will be benchmarked against the Russell 1000 Growth Index, which is tracked by the $31 billion Vanguard Russell 1000 Growth ETF (VONG).

VUSG is essentially a carveout of Wellington’s strategy for the Vanguard Global Equity Fund (VHGEX), which holds more than 500 stocks across 30 countries. The ETF version will be far more concentrated and focused exclusively on U.S. stocks.

Morning Star: VHGEX

VUSV

The Vanguard Wellington U.S. Value Active ETF (VUSV) will hold about 80 stocks and follow a contrarian value style. It will use the Russell 1000 Value Index as its benchmark, the index behind the $13.4 billion Vanguard Russell 1000 Value ETF (VONV).

The strategy is based on the Wellington sleeve of the Vanguard Windsor Fund (VWNDX), which is currently co-managed by Wellington and Pzena Investment Management.

Morning Star: VWNDX