Appearance

期权策略ETF(BuyWrite & PutWrite)

ETF列表

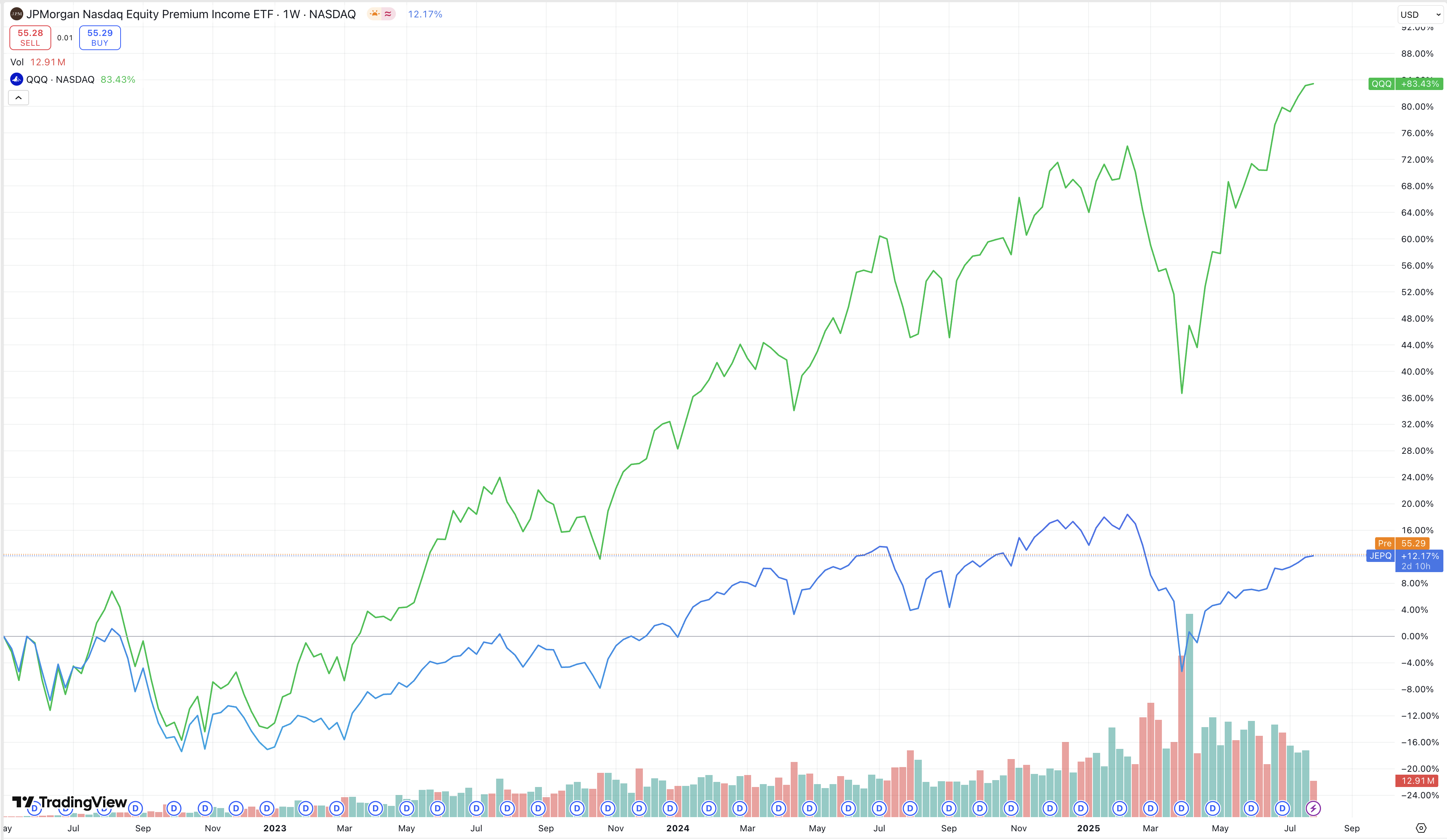

JEPQ vs QQQ

JPMorgan Nasdaq Equity Premium Income ETF(JEPQ) 成立于2022年3月5日,如果比较相同时间段的JEPQ和纳斯达克ETF QQQ。

纯价格比较:

- 从2022年3月,到2025年7月,QQQ的价格收益为83.43%,折算年化收益约为19.96%。

- 从2022年3月,到2025年7月,JEPQ的价格收益为12.17%,折算年化收益约为3.5%。

在加上派息率,假设

- QQQ按最近12个月的派息率0.5%计算。

- JEPI按最近12个月的派息率10.42%计算。

总收益(近似):

- QQQ的总年化收益近似为:20.46%。

- JEPQ的总年化收益近似威: 13.92%。

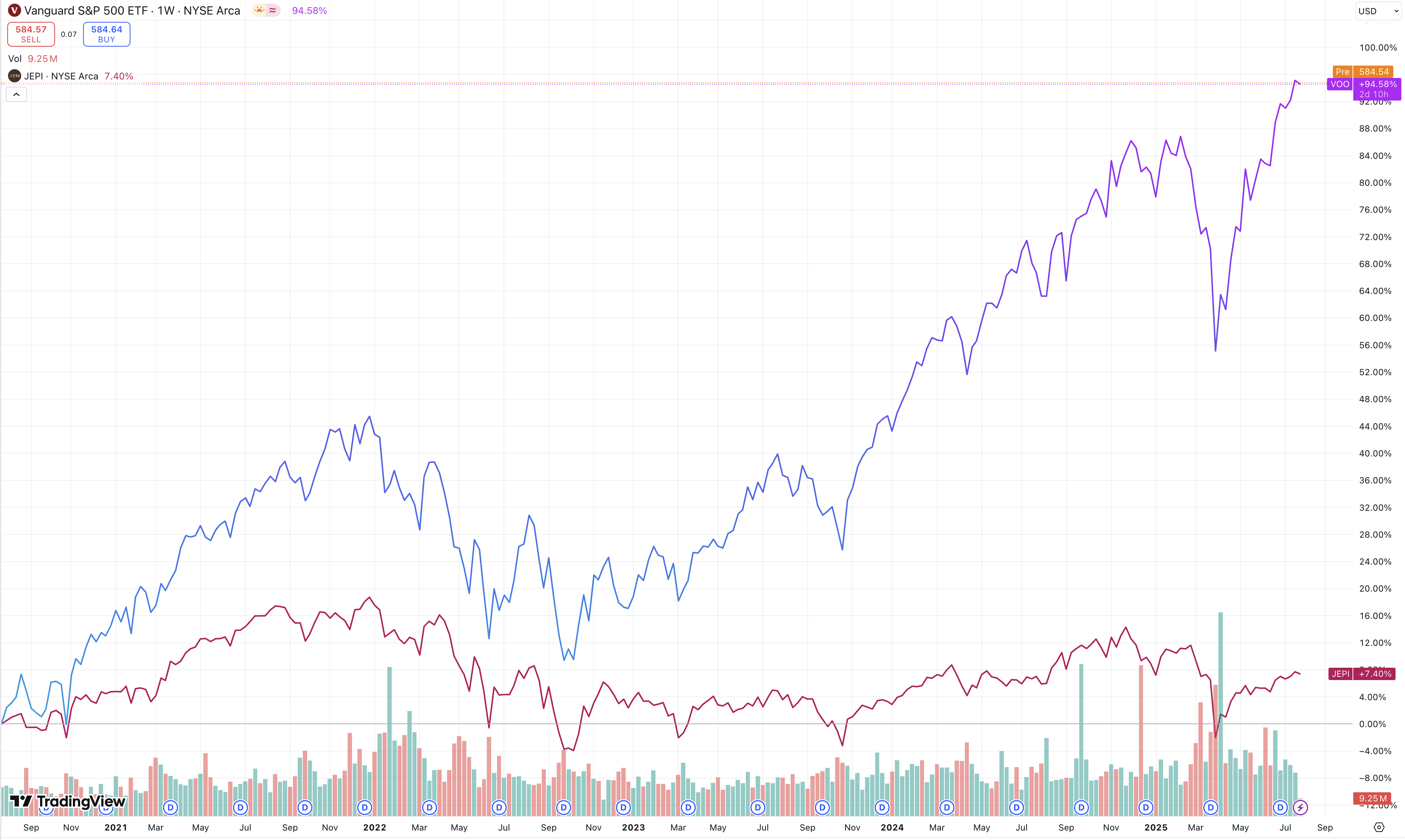

JPEI vs VOO

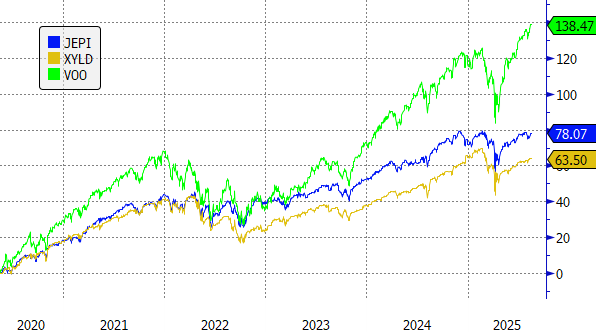

JPMorgan Equity Premium Income ETF(JEPI)成立于2020年5月20,如果比较相同时间段的JEPI和标普500ETF VOO。

纯价格比较:

- 从2020年5月,到2025年7月,VOO的价格收益为94.58%,折算年化收益约为13.75%。

- 从2020年5月,到2025年7月,JEPI的价格收益为7.4%,折算年化收益约为1.39%。

在加上派息率,假设

- VOO按最近12个月的派息率1.2%计算。

- JEPI按最近12个月的派息率7.39%%计算。

总收益(近似):

- VOO的总年化收益近似为:14.95%。

- JEPI的总年化收益近似威: 8.78%。

Eifert wrote on X

History

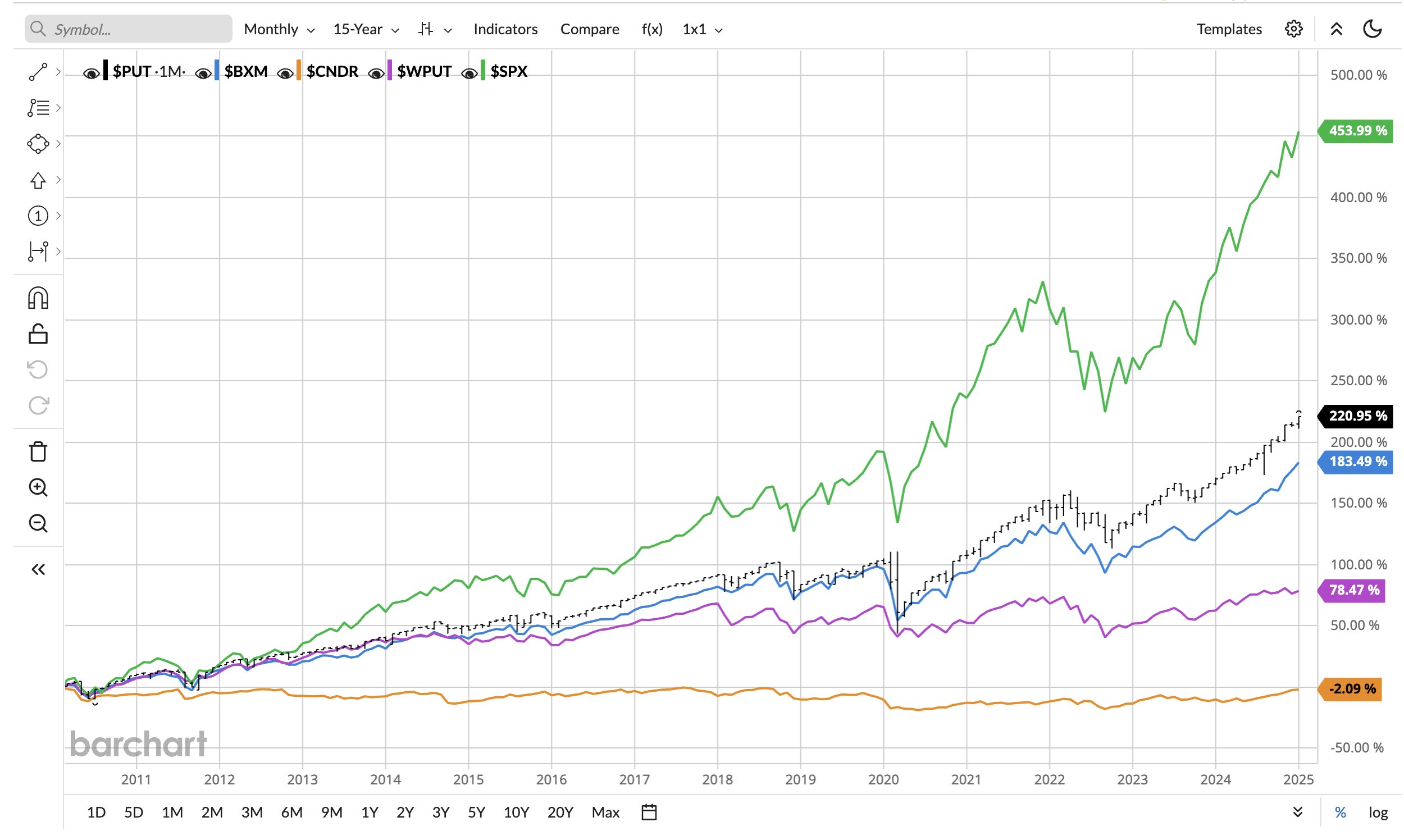

Before 2010 or so, options markets were sort of a backwater. Risk premium was relatively high, so if you backtested simple option selling strategies like covered calls or cash-secured puts, they looked pretty good (see PUT INDEX, BXM INDEX)

Then pension fund consultants started to write white papers and pitch "equity like returns with lower risk via option selling" to their massive clients.

And by 2012, tens of billions of dollars of institutional money started to flow into benchmark-oriented option selling run by managers like Neuberger Berman, Parametric and the like.

Meanwhile, retail investors started to catch the bug as well, with the rise of TastyTrade for do-it-yourselfers and various asset management industry products sold to private wealth managers.

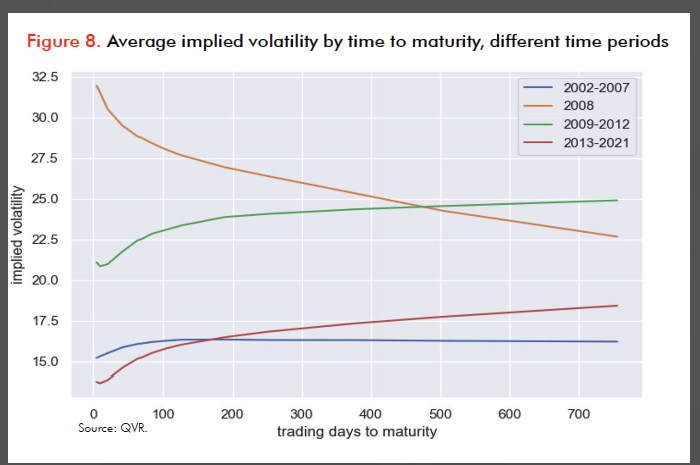

Option Term Structure Change

Remember that derivatives markets are relatively small, they're not whole asset classes that you're supposed to be able to invest tens or hundreds of billions of dollars in without moving prices around. So this moved prices!

The typical S&P volatility term structure went from mildly upward sloping and elevated, to highly depressed in front and extremely steeply upward sloping, as by the late-2010's there were only sellers of benchmark 1-month relatively near the money options.

Option Selling vs Owning Equities

Option selling dramatically underperforms owning equities.

- Cboe S&P 500 PutWrite Index(PUT)

- The PUT portfolio is composed of one- and three-month Treasury bills and of a short position in at-the-money put options on the S&P 500 index (SPX puts)

- The PUT portfolio is rebalanced monthly, typically on the third Friday of the month when SPX options expire. A new number of SPX puts is then sold.

- Cboe S&P 500 BuyWrite Index(BXM)

- The BXM is a passive total return index based on (1) buying an S&P 500 stock index portfolio, and (2) "writing" (or selling) the near-term S&P 500 Index (SPXSM) "covered" call option, generally on the third Friday of each month.

- The SPX call written will have about one month remaining to expiration, with an exercise price just above the prevailing index level (i.e., slightly out of the money). The SPX call is held until expiration and cash settled, at which time a new one-month, near-the-money call is written.

- Cboe S&P 500 Iron Condor Index (CNDR)

- (1) sells a monthly Out-of-the-Money (OTM) SPX Put option (delta ≈ - 0.20) and a monthly Out-of-the-Money (OTM) SPX Call option (delta ≈ 0.20),

- (2) buys a monthly OTM SPX Put option (delta ≈ - 0.05) and a monthly OTM SPX Call option (delta ≈ 0.05) to reduce the risk and

- (3) holds a Treasury bill account invested in one-month Treasury bills, which is rebalanced on the option Roll Day and is designed to limit the downside return of the CNDR Index.

- Cboe S&P 500 One-Week PutWrite Index(WPUT)

- While the PUT sells SPX puts monthly, WPUT sells an SPX put weekly.

- Another difference is that the Treasury bills are one-month bills only instead of one and three-month bills.

- The WPUT portfolio is rebalanced weekly, typically on Fridays after the expiration of SPX options that expire weekly (SPX weekly options). SPX weekly options expire at the close, except on the third Friday of the month, when they expire at 11 am ET. A new weekly SPX put is then sold.

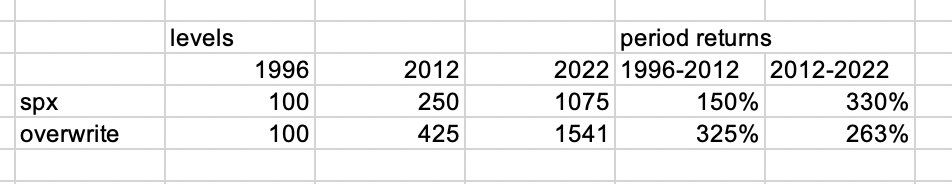

Here's a cute little table with pre- and post-2012. Think of it like the in sample and out of sample period for the backtest

Safe, unleveraged, risk-contained option selling in iron condor format has been flat for 15 years (the out of sample period)

There are tons of YieldMax ETFs doing covered calls on singlenames now. Look at every single one of them and compare it to owning the underlying. You're just losing money.

etf.com 数据

JEPI, MSTY Under Fire: Hedge Fund Manager Slams Covered Call ETFs

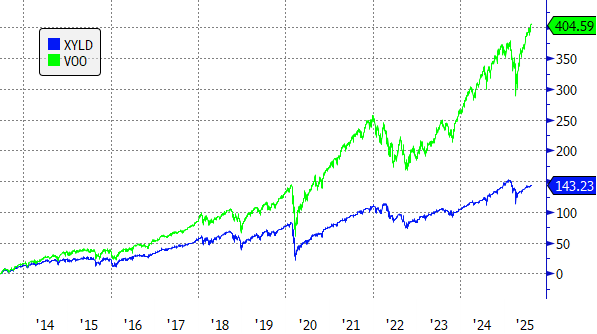

- The Global X S&P 500 Covered Call ETF (XYLD), which writes monthly at-the-money calls on the S&P 500, has returned 143% since its 2013 inception.

- The Vanguard S&P 500 ETF (VOO) is up 405% over the same period.

According to JPMorgan marketing materials, JEPI aims for roughly 6–10% in annual distributions plus some equity upside.

Since its 2020 debut, JEPI is up 78%, beating XYLD’s 64% but still well behind VOO’s 138%.

联系小丸子

加微信后留言「境外」,可加入「境外投资讨论群」;留言「分红」,可加入"了解香港保险的群"(保险群暂时不对保险从业人员开放,见谅~)

还建一个付费知识星球,用来同步家庭四账户的实盘操作、分享投资知识、与同频的小伙伴深度交流投资,目前正在试运营,有兴趣可扫码加入。