Appearance

美国半导体ETF

SMH vs SOXX vs SOXQ

| SMH | SOXX | SOXQ | |

|---|---|---|---|

| ETF 名称 | VanEck Semiconductor ETF | iShares Semiconductor ETF | Invesco PHLX Semiconductor ETF |

| 跟踪指数 | MVIS US Listed Semiconductor 25 Index(MVSMH) | NYSE Semiconductor Index(ICESEMI) NYSE半导体指数 | PHLX Semiconductor Sector Index(SOX) 费城半导体指数 |

| 成分股数量 | 25 | 30 | 30 |

| 规模(2025/12/19) | $39.13B | $17.67B | $857.57M |

| 费率 | 0.35% | 0.34% | 0.19% |

| 成立时间 | 2011/12/20 | 2001/6/10 2021年6月21日跟踪指数从SOX更换到ICESEMI | 2021/06/11 |

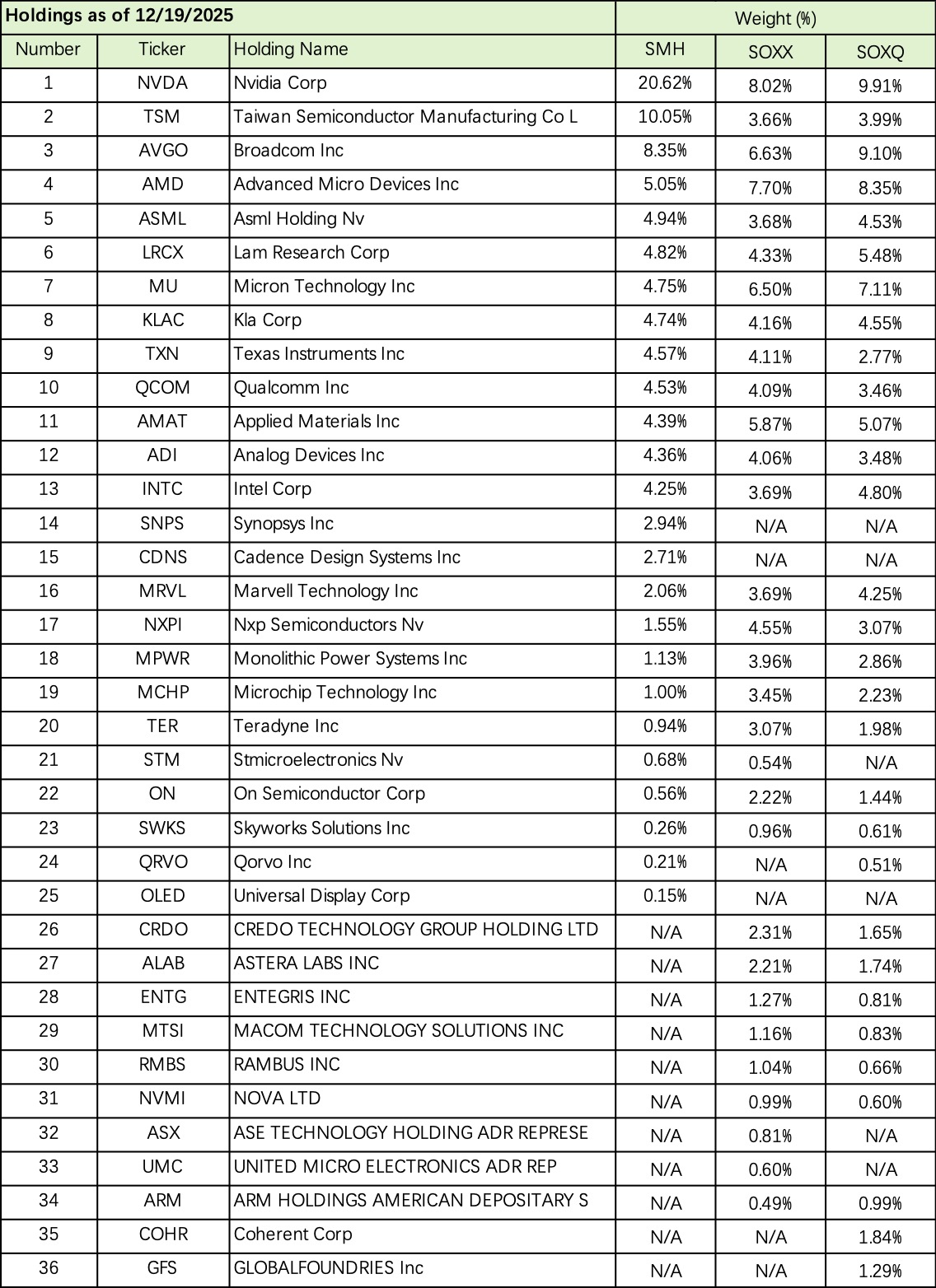

SMH vs SOXX vs SOXQ 成分股比较

费城半导体指数(PHLX Semiconductor Sector Index)

The PHLX Semiconductor Sector IndexTM (SOXTM) is a modified market capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture, and sale of semiconductors.

The Index is designed to measure the performance of the 30 largest U.S.-listed securities of companies engaged in the semiconductor business.

NYSE半导体指数(NYSE Semiconductor Index,ICE Semiconductor Index)

The ICE Semiconductor Index is a rules-based, modified float-adjusted market capitalization-weighted index that tracks the performance of the thirty largest U.S.-listed semiconductor companies.

This industry includes companies that either manufacture materials that have electrical conductivity (semiconductors) to be used in electronic applications or utilize LED and OLED technology.

It also includes companies that provide services or equipment associated with semiconductors such as packaging and testing.

基于NYSE Semiconductor Index的杠杆ETF

MVIS US Listed Semiconductor 25 Index (MVSMH)

The MVIS US Listed Semiconductor 25 Index (MVSMH) tracks the performance of the 25 largest and most liquid US exchange-listed companies in the semiconductor industry.

This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from semiconductors or semiconductor equipment.