Appearance

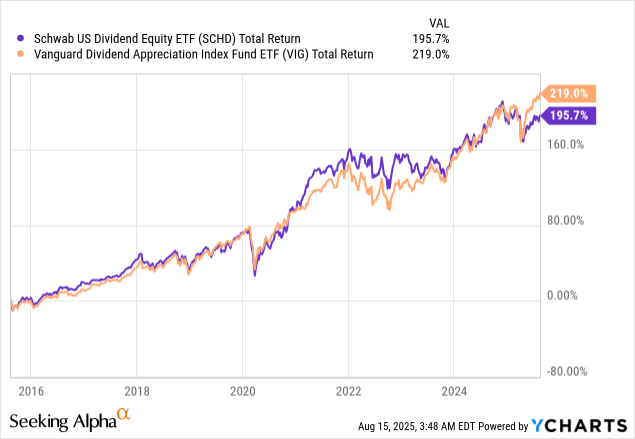

SCHD vs VIG

Total Return

Industry Exposure

| Industry | VIG (%) | SCHD (%) |

|---|---|---|

| Information Technology | 26.60% | 9.00% |

| Financials | 22.50% | 8.91% |

| Health Care | 14.60% | 15.53% |

| Industrials | 11.60% | 12.50% |

| Consumer Staples | 10.10% | 18.81% |

| Consumer Discretionary | 5.30% | 8.38% |

| Materials | 3.20% | 3.07% |

| Energy | 2.80% | 19.23% |

| Utilities | 2.70% | 0.04% |

| Communication Services | 0.60% | 4.52% |

Equity Exposure

| Industry | VIG (%) | SCHD (%) |

|---|---|---|

| Broadcom Inc. | 6.01% | |

| Microsoft Corp. | 5.20% | |

| JPMorgan Chase & Co. | 4.07% | |

| Apple Inc. | 3.42% | |

| Eli Lilly & Co. | 2.85% | |

| Visa Inc. Class A | 2.70% | |

| Exxon Mobil Corp. | 2.38% | |

| Mastercard Inc. Class A | 2.27% | |

| Walmart Inc. | 2.08% | |

| Costco Wholesale Corp | 2.04% | |

| Chevron Corp. | 4.32% | |

| PepsiCo Inc. | 4.31% | |

| ConocoPhillips | 4.25% | |

| Altria Group Inc. | 4.20% | |

| Home Depot Inc. | 4.16% | |

| Cisco Systems Inc. | 4.16% | |

| AbbVie Inc. | 4.09% | |

| Merck & Co. Inc. | 4.02% | |

| Texas Instruments Inc. | 3.86% | |

| Verizon Communications Inc. | 3.85% | |

| Total | 33.02% | 41.22% |

Performance

| Metric | VIG | SCHD |

|---|---|---|

| AUM | $78.7 | $56.0 |

| YTD CAGR | 7.87% | 5.54% |

| 1Y CAGR | 12.89% | 9.48% |

| 3Y CAGR | 6.33% | 4.63% |

| 5Y CAGR | 11.65% | 12.67% |

| 10Y CAGR | 11.50% | 11.30% |

Dividends

| Metric | VIG | SCHD |

|---|---|---|

| Dividend Yield | 1.68% | 3.75% |

| 3Y DGR | 8.1% | 21.7% |

| 5Y DGR | 39.5% | 70.0% |

| 10Y DGR | 82.3% | 174.0% |