Appearance

JPMorgan Nasdaq Equity Premium Income ETF

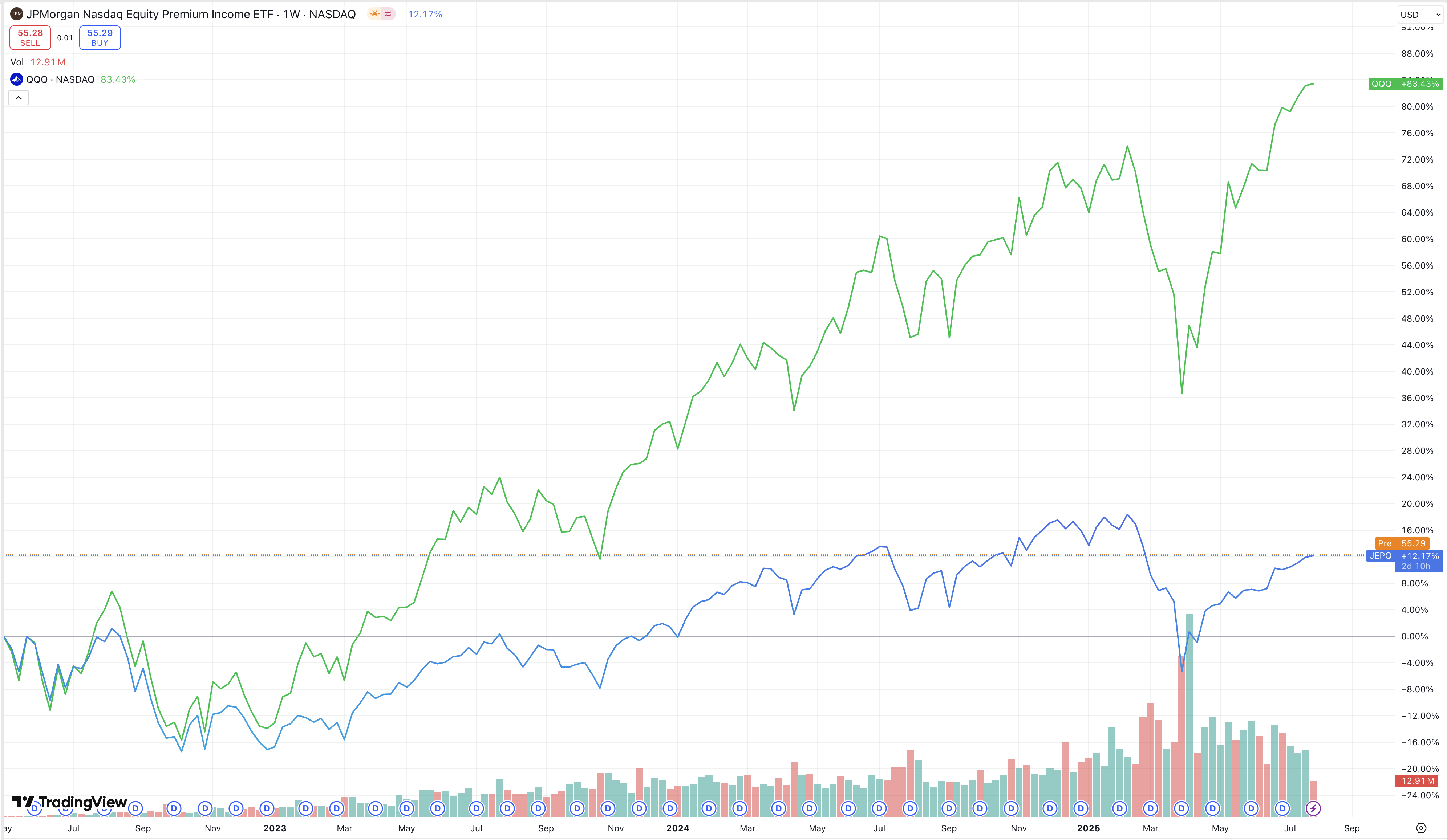

JEPQ 成立于2022年3月5日,如果比较相同时间段的JEPQ和纳斯达克ETF QQQ。

从2022年3月,到2025年7月,QQQ的价格收益为83.43%,折算年化收益约为19.96%。

从2022年3月,到2025年7月,JEPQ的价格收益为12.17%,折算年化收益约为3.5%。

在加上派息率,假设

- QQQ按最近12个月的派息率0.5%计算。

- JEPI按最近12个月的派息率10.42%计算。

QQQ的总年化收益近似为:20.46%。

JEPQ的总年化收益近似威: 13.92%。

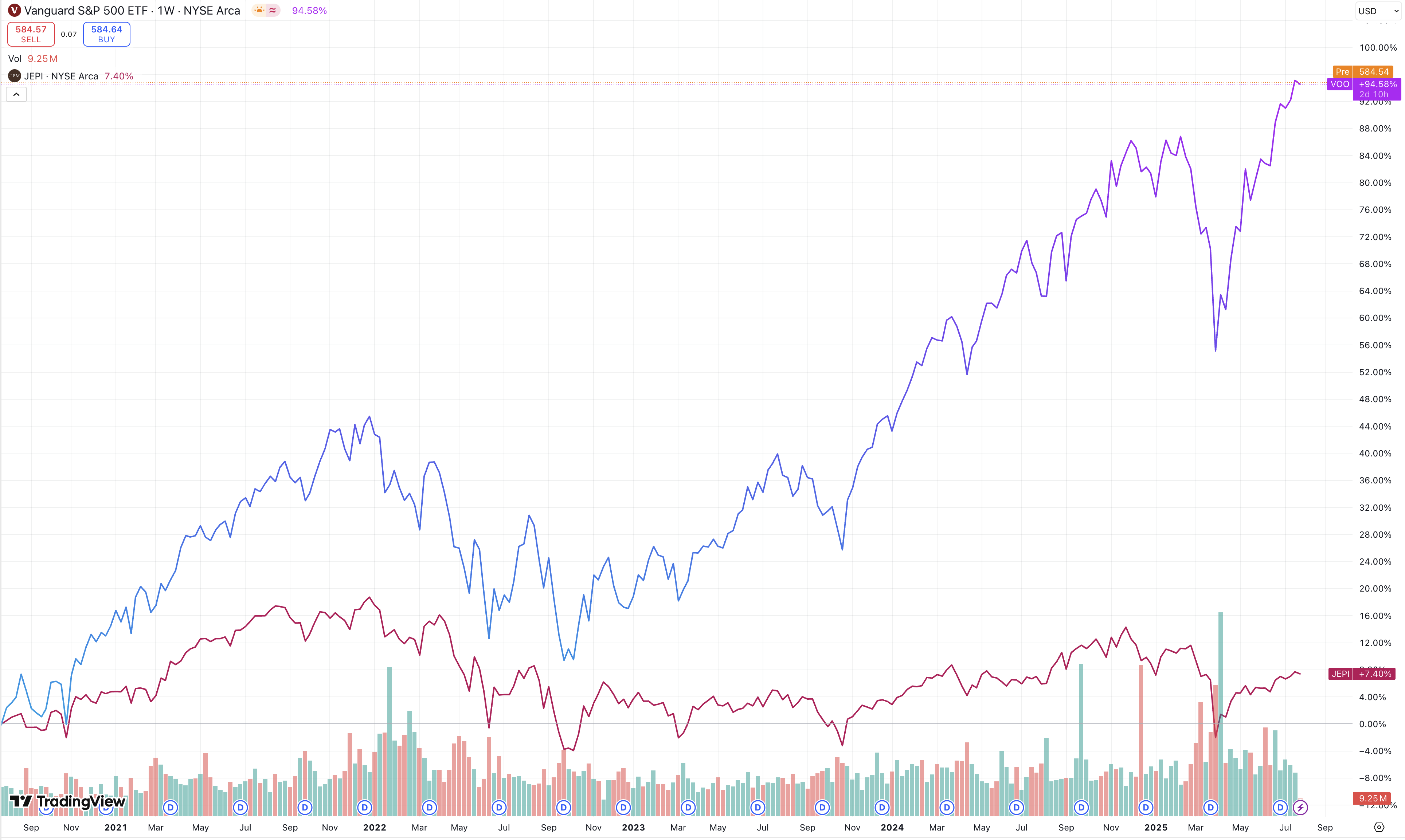

JEPI成立于2020年5月20,如果比较相同时间段的JEPI和标普500ETF VOO。

从2020年5月,到2025年7月,VOO的价格收益为94.58%,折算年化收益约为13.75%。

从2020年5月,到2025年7月,JEPI的价格收益为7.4%,折算年化收益约为1.39%。

在加上派息率,假设

- VOO按最近12个月的派息率1.2%计算。

- JEPI按最近12个月的派息率7.39%%计算。

VOO的总年化收益近似为:14.95%。

JEPI的总年化收益近似威: 8.78%。

Prospectus

Ticker: JEPQ

What is the goal of the Fund?

The Fund seeks current income while maintaining prospects for capital appreciation.

Fees and Expenses of the Fund

Total Annual Fund Operating Expenses: 0.35%

Portfolio Turnover

A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a tax-able account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 168% of the average value of its portfolio.

What are the Fund’s main investment strategies?

The investment objective of the Fund is to seek current income while maintaining prospects for capital appreciation.

The Fund seeks to achieve this objective by

(1) creating an actively managed portfolio of equity securities comprised significantly of those included in the Fund’s primary benchmark, the Nasdaq-100 Index® (the Benchmark), and

(2) through equity-linked notes (ELNs), selling call options with exposure to the Benchmark.

The resulting Fund is designed to provide investors with performance that captures a majority of the returns associated with the Benchmark, while exposing investors to lower volatility than the Benchmark and also providing incremental income.

The Fund is managed in a way that seeks, under normal circumstances, to provide monthly distributions at a relatively stable level.

Under normal circumstances, the Fund invests at least 80% of its Assets in equity securities (80% Policy). “Assets” means net assets plus the amount of borrow-ings for investment purposes. In calculating the 80% Policy, the Fund’s equity investments will include common stocks and ELNs, as well as other equity securities. In implementing the Fund’s strategy, the Fund invests significantly in the equity securities of companies included in the Benchmark (which includes both large cap and mid cap companies). The Fund may also invest in other equity securities not included in the Benchmark. The Fund may receive income to the extent it invests in equity securities of companies that pay dividends; however, securities are not selected based on anticipated dividend payments. Currently, many of the equity securities in the Fund’s portfolio will be technology companies or companies that rely heavily on technological advances.

The Fund seeks a lower volatility level than the Benchmark. Volatility is one way to measure risk and refers to the variability of the Fund’s or the market’s returns. If the Fund is successful in providing lower volatility, then the value of the Fund’s portfolio will fluctuate less than the Benchmark over a full market cycle (typically, a 3-5 year time horizon).

In order to generate income, the Fund may invest up to 20% of its net assets in ELNs.

ELNs are structured as notes that are issued by counterparties, including banks, broker-dealers or their affiliates, and that are designed to offer a return linked to the underlying instruments within the ELN.

ELNs in which the Fund invests are derivative instruments that are specially designed to combine the economic characteristics of the Benchmark and written call options in a single note form and are not traded on an exchange.

The options underlying the ELNs will be based on the Benchmark or on exchange-traded funds (ETFs) that replicate the Benchmark.

Selling a call option entitles the seller to a premium equal to the value of the option at the time of trade.

The ELNs owned by the Fund are structured to use a covered call strategy and have short call positions embedded within them.

When the Fund purchases the ELN from the issuing counterparty, the Fund is entitled to the premium generated by the short call position within the ELN. Therefore, the ELNs provide recurring cash flow to the Fund based on the premiums received from selling the call options and are an important source of the Fund’s return.

When the Fund sells call options within an ELN, it receives a premium but limits its opportunity to profit from an increase in the market value of either the underlying Benchmark or ETF to the exercise price (plus the premium received).

The maximum potential gain on an underlying instrument will be equal to the difference between the exercise price and the purchase price of the underlying Benchmark or ETF at the time the option is written, plus the premium received.

Investing in ELNs may also reduce the Fund’s volatility because the income from the ELNs would reduce potential losses incurred by the Fund’s equity portfolio.

The ELNs are reset periodically to seek to better capitalize on current market conditions and opportunities; these resets assist the Fund in seeking to provide relatively stable returns.

The Fund invests in a non-diversified portfolio of securities.

The Fund will not invest more than 25% of the value of its total assets in the securities of companies conducting their principal business activities in the same industry, except that, to the extent that an industry represents 20% or more of the Fund’s benchmark at the time of investment, the Fund may invest up to 35% of its total assets in that industry.

Investment Process: In managing the equity portion of the Fund’s portfolio, the adviser employs a fundamental data sci- ence enabled investment approach that combines research, data insights, and risk management. The adviser defines data science as the discipline of extracting useful insights from col- lections of information, and the adviser utilizes the insights as a part of its investment process. The adviser utilizes proprietary techniques to process, analyze, and combine a wide variety of data sources, including the adviser’s multi-decade history of proprietary fundamental research, company financial state- ments, and a variety of other data sources that the adviser finds relevant to conducting fundamental analysis. The adviser combines insights derived from these sources to forecast the financial prospects of each security, also known as fundamental analysis. Alongside its own insights, the Fund’s portfolio management team uses the forecasts developed through data science techniques to help to identify securities that are priced favorably relative to their associated levels of risk. The Fund’s portfolio management team then constructs a portfolio that seeks to maximize expected future financial performance while controlling for key risks to the underlying companies’ busi- nesses identified by the adviser’s analysis. The adviser assesses key risk by analyzing potential events or conditions that may have a negative impact on the adviser’s valuation of a particular security. Such key risks may include, but are not limited to, sensitivity to changes in macroeconomic conditions, competi- tive risks from existing companies or new entrants, and operational risks related to the companies’ business models. The adviser continuously evaluates the efficacy of the sources of information included within the investment process, and seeks to identify new data sources that will be additive to the adviser’s forecasts and portfolio construction. As part of its investment process, the adviser seeks to assess the impact of environmental, social and governance (ESG) fac- tors on many issuers in the universe in which the Fund may invest. The adviser’s assessment is based on an analysis of key opportunities and risks across industries to seek to identify financially material issues with respect to the Fund’s invest- ments in securities and ascertain key issues that merit engage- ment with issuers. These assessments may not be conclusive, and securities of issuers that may be negatively impacted by such factors may be purchased and retained by the Fund while the Fund may divest or not invest in securities of issuers that may be positively impacted by such factors. The adviser may sell a security for several reasons. A security may be sold due to a change in the company’s fundaments or if the adviser believes the security is no longer attractively valued relative to its associated levels of risk. Investments may also be sold if the adviser identifies a stock that it believes offers a bet- ter investment opportunity. The Fund’s investment strategies may involve active and frequent trading resulting in high portfolio turnover.

The Fund’s Main Investment Risks

Equity-Linked Notes Risk.

When the Fund invests in ELNs, it receives cash but limits its opportunity to profit from an increase in the market value of the instrument because of the limits relating to the call options written within the particular ELN.

Investing in ELNs may be more costly to the Fund than if the Fund had invested in the underlying instruments directly.

Investments in ELNs often have risks similar to the underlying instruments, which include market risk.

In addition, since ELNs are in note form, ELNs are subject to certain debt securities risks, such as credit or counterparty risk.

**Should the prices of the underlying instruments move in an unexpected manner, the Fund may not achieve the anticipated benefits of an investment in an ELN, and may realize losses, which could be significant and could include the Fund’s entire principal investment. **

Investments in ELNs are also subject to liquidity risk, which may make ELNs difficult to sell and value.

A lack of liquidity may also cause the value of the ELN to decline.

In addition, ELNs may exhibit price behavior that does not correlate with the underlying securities.

The Fund’s ELN investments are subject to the risk that issuers and/or counterparties will fail to make pay- ments when due or default completely. Prices of the Fund’s ELN investments may be adversely affected if any of the issuers or counterparties it is invested in are subject to an actual or perceived deterioration in their credit quality.

Covered Call Strategy Risk.

When the Fund sells call options within an ELN, it receives cash but limits its opportunity to profit from an increase in the market value of the underlying instrument to the exercise price (plus the premium received).

The maximum potential gain on the underlying Benchmark or ETF (each, an underlying instrument) will be equal to the difference between the exercise price and the purchase price of the underlying instrument at the time the option is written, plus the premium received.

In a rising market, the option may require an underlying instrument to be sold at an exercise price that is lower than would be received if the instrument was sold at the market price.

If a call expires, the Fund realizes a gain in the amount of the premium received, but because there may have been a decline (unrealized loss) in the market value of the underlying instrument during the option period, the loss realized may exceed such gain.

If the underlying instrument declines by more than the option premium the Fund receives, there will be a loss on the overall position.